Are you grappling with the complexities of New York taxes, feeling lost in a maze of rates, brackets, and deductions? Navigating the tax landscape in the Empire State requires a keen understanding of both state and local regulations, and a misstep can lead to significant financial consequences.

From the bustling streets of New York City to the serene landscapes of the Adirondacks, residents and businesses across the state are subject to a variety of taxes. These include income tax, sales tax, property tax, and, in certain cases, estate tax. The details, however, can be overwhelming. This article will delve into the intricacies of New York's tax system, providing clarity and guidance to help you make informed financial decisions. We will explore the key aspects, from income tax brackets and city tax rates to estate tax thresholds and the STAR program, designed to offer some relief to homeowners.

Let's break down the key elements, starting with the basics and proceeding to the more nuanced aspects.

In addition to the myriad of taxes, several other financial obligations confront New Yorkers. Businesses, for instance, must also navigate sales tax collection, hotel occupancy fees, and parking taxes. The following table offers a comprehensive look at these diverse tax areas, simplifying the complexities.

| Tax Type | Description | Applicability | Key Details |

|---|---|---|---|

| Income Tax | Tax levied on the income earned by individuals, LLCs, and partnerships. | All residents and entities earning income within New York State. |

|

| Sales Tax | Tax on the sale of goods and services. | Businesses selling taxable goods or services. |

|

| Property Tax | Tax on real estate. | Homeowners and property owners. |

|

| Estate Tax | Tax on the transfer of assets upon death. | Estates exceeding a certain threshold. |

|

| Hotel Occupancy Tax | Fee on hotel occupancy. | Hotel guests in New York City. |

|

| Parking Services Tax | Tax on parking services. | Users of parking services in NYC. |

|

The New York State Department of Taxation and Finance is the primary source of information on these and other tax-related matters. Their website, https://www.tax.ny.gov/, provides comprehensive resources for individuals and businesses. The site offers tools to calculate taxes, file returns, and understand the latest tax laws.

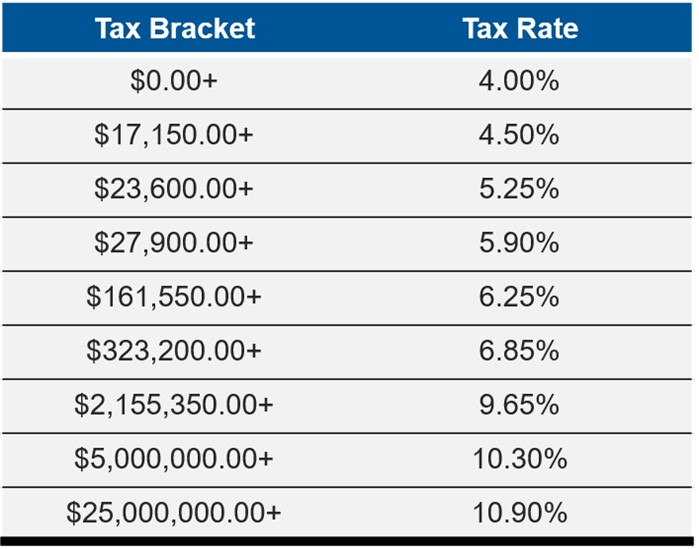

Income tax in New York is a significant consideration for residents. The state's income tax system is progressive, with nine tax brackets. This means that as your income increases, the percentage of tax you pay also increases, reaching a maximum marginal income tax rate of 10.900% as of 2025. However, keep in mind that the specific rates change annually. Understanding the applicable tax brackets is essential for accurate tax planning and compliance.

For the 2024 tax year, which will be filed in 2025, New York City residents face additional income tax obligations. The city's income tax has four brackets, ranging from 3.078% to 3.876%. Your position within these brackets is based on your filing status and annual earnings. As with the state income tax, the amount of tax you pay to New York City is determined by your income level.

To calculate your New York State and local income taxes, you can use a free tool available on the New York State Department of Taxation and Finance website. This calculator helps you determine your tax obligations for 2023 and the current tax year, including the latest federal and state tax rates. Comparing tax rates, brackets, deductions, and exemptions across different filing statuses and locations can help you optimize your tax position.

Beyond income tax, sales tax is another critical aspect of New York's tax landscape. Businesses are generally required to collect sales tax on the sale of goods and services. The sales tax rates vary based on the location, encompassing state, county, and city taxes. For instance, the borough of Manhattan has specific additional tax requirements. These variations require businesses to be vigilant in complying with the rules. In addition, hotel occupancy and parking services in New York City incur additional taxes.

For those considering the transfer of assets, New York's estate tax comes into play. The estate tax applies to the transfer of assets upon death if the estate exceeds a certain threshold. As of 2023, the estate tax exemption threshold is $6.58 million. Navigating these rules and considering strategies to minimize liabilities is essential for estate planning.

Residents of New York City also face additional income tax obligations. These are applied on top of state income taxes. The rates vary based on income brackets, ranging from 3.078% to 3.876% for the 2024 tax year.

In the realm of property taxes, the School Tax Relief (STAR) program offers some relief to eligible homeowners. If you qualify and are enrolled in the STAR program, you receive your benefit annually through a check or direct deposit, depending on your registration.

For those starting a new business in New York, the New York State Tax Guide for New Businesses (Publication 20) is an essential resource. This guide offers detailed descriptions of various tax obligations, helping new businesses understand their responsibilities. Businesses must be aware of their obligation to collect sales tax.

The website, https://www.tax.ny.gov/, belongs to an official New York State government organization, which is the most reliable source. In the world of tax, this means you can trust the information.