Are you navigating the complexities of California taxes, searching for clarity amidst the often-confusing landscape of state regulations? Understanding the intricacies of the California Franchise Tax Board (FTB) is crucial for every individual and business operating within the Golden State, and staying informed can save you both time and money.

The California Franchise Tax Board (FTB) is the agency responsible for administering California's tax laws. This includes collecting state income taxes for individuals and corporations, as well as various other taxes and fees. Navigating the FTB's resources and understanding its processes can sometimes feel like a challenge, but it's a necessary one for responsible tax compliance. The FTB provides numerous online services and resources to assist taxpayers, including online filing options, payment portals, and access to forms and publications. However, staying current with the latest updates and understanding the nuances of the tax code is paramount.

The FTB's website, a.ca.gov, serves as a primary point of access for information and services. The site is designed to provide taxpayers with the tools and resources they need to meet their state tax obligations. From accessing forms to making payments and checking refund status, the online portal aims to streamline the tax process.

Taxpayer Information and Access: The FTB provides various avenues for taxpayers to access information and manage their tax affairs. These include:

- MyFTB Account: A secure online portal where taxpayers can manage their accounts, view tax information, and communicate with the FTB. This service allows users to file a return, make a payment, and check their refund status, among other things.

- Online Services: The FTB offers a range of online services to facilitate tax-related activities. These include tax calculators, forms, and publications.

- Phone and Mail: Taxpayers can also contact the FTB by phone or mail for assistance with tax-related inquiries.

Key Services and Actions:

- Filing Your Return: Whether youre filing as an individual or a business, the FTB provides the necessary forms and online tools to complete your tax return. Options like CalFile are available for electronic filing.

- Making Payments: The FTB offers various payment methods, including online payments, to ensure timely tax payments.

- Checking Your Refund: Taxpayers can check the status of their state tax refund through the FTBs online portal.

- Accessing Forms and Publications: The FTB website is a repository for all necessary forms and publications.

Important Dates and Updates:

As of January 15, 2025, the FTB website was last updated. Stay informed with the following points:

- Entity status letter requests made within a certain period may show the old entity name until FTB records are updated.

- The California Franchise Tax Board certified on July 1, 2023, that the website is designed to be accessible.

The FTB website's accessibility is a key consideration. The website is designed to be accessible, and it is in compliance with California Government Code sections 7405 and 11135. This commitment ensures that all taxpayers, regardless of their abilities, can access and use the FTB's online resources. The commitment is evident as of July 1, 2023.

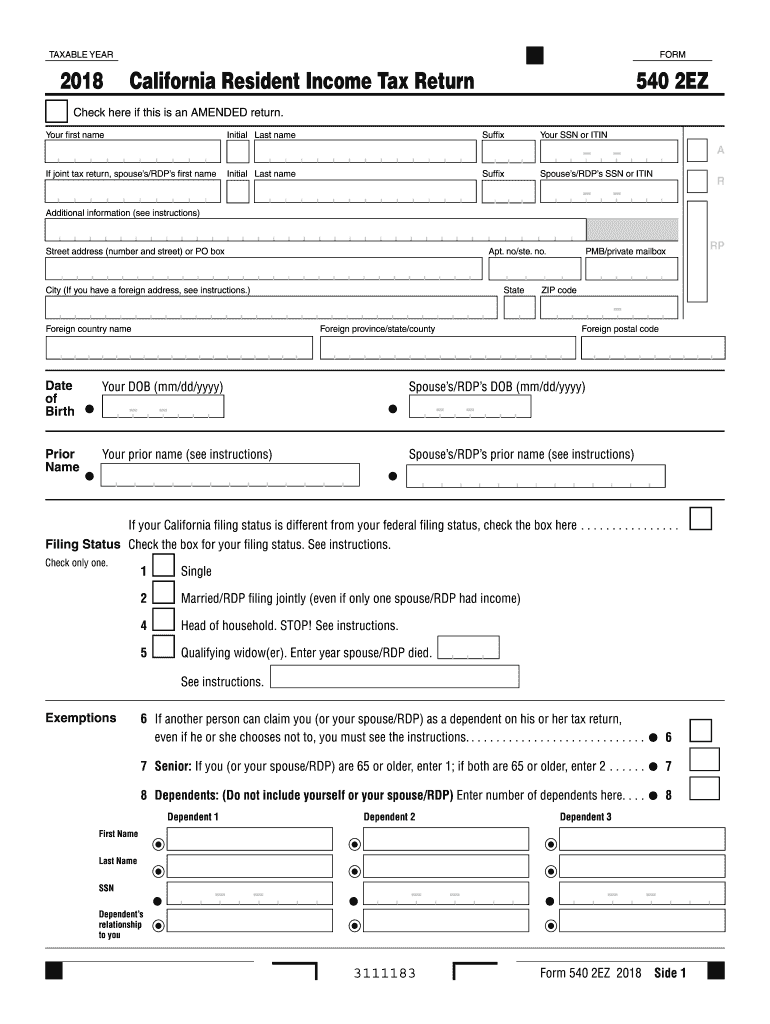

When using specific online services, such as the tax calculator, it's essential to provide accurate and complete information. For instance, when calculating your tax liability, you will need to enter your California taxable income, which can be found on line 19 of your 2024 Form 540 or Form 540NR. The calculator is not designed for Form 540 2EZ, and those taxpayers will need to refer to the 540 2EZ tax tables available on the tax calculator, tables, and rates page.

For those needing additional assistance, the Volunteer Income Tax Assistance (VITA) program is available. The VITA program offers free tax help to people who qualify, providing support for those who may need it.

The FTB provides comprehensive resources and information, its important to ensure that you are using the correct forms and providing accurate information. Whether you are filing your return, making a payment, or checking your refund status, the FTB website is designed to be a reliable resource.

When accessing services, be mindful of the security protocols. For instance, when logging in to your MyFTB account, make sure you enter your Social Security Number (SSN) and last name precisely as they appear in FTB records. The combination must match our records in order to access this service. The SSN field requires nine numbers, without spaces or dashes.

The following are common areas in which individuals and businesses may need assistance:

- Tax Filing:The process of preparing and submitting your tax return. This includes gathering the necessary documentation, selecting the correct forms, and accurately reporting your income, deductions, and credits.

- Making Payments:Ensuring timely and accurate tax payments. This includes knowing the payment deadlines, understanding available payment methods, and accurately calculating the amount due.

- Understanding Deductions and Credits:Familiarizing yourself with the deductions and credits you are eligible for. This can significantly impact your tax liability and potentially lower the amount you owe or increase your refund.

- Navigating Online Portals:Successfully navigating the FTBs online portals, such as MyFTB, to access information, file tax returns, and manage your tax account.

- Responding to FTB Notices:Understanding and responding to notices you may receive from the FTB. These notices can relate to various issues, such as missing information, audits, or assessments.

Disclaimer

This article provides general information about the California Franchise Tax Board (FTB) and its services. It is not intended to be legal or tax advice. Tax laws and regulations are complex and subject to change. Consult with a qualified tax professional for personalized advice. The information provided is current as of the last update date of the FTB website, 01/15/2025. Always refer to the official FTB website (a.ca.gov) and relevant tax documents for the most up-to-date information.