Are you finding yourself overwhelmed by the complexities of household payroll and taxes? There's a simple, affordable, and surprisingly stress-free solution: Poppins Payroll. This service is transforming the way families manage their domestic staff, offering a streamlined approach to payroll, taxes, and compliance.

Poppins Payroll emerges as a beacon of simplicity in a world of intricate financial obligations. This service isn't just about paying your nanny or housekeeper; it's about ensuring you do so legally, efficiently, and with complete peace of mind. From the initial sign-up to ongoing payroll management, Poppins Payroll simplifies the entire process. It is designed to alleviate the common burdens associated with employing domestic staff, offering a transparent, user-friendly experience. This is especially relevant in states like Virginia, where minimum wage laws and overtime regulations add another layer of complexity.

Poppins Payroll takes the guesswork out of the equation. It automatically calculates the appropriate withholding amounts for each paycheck and ensures that the correct amounts are remitted to the relevant government agencies. The service also keeps track of any changes in tax laws, meaning employers don't have to.

Here's a breakdown of the key features and benefits of using Poppins Payroll for household staff:

| Feature | Benefit |

|---|---|

| Automatic Payroll Calculations | Eliminates manual calculations, ensuring accuracy and saving time. |

| Direct Deposit | Provides a convenient and secure way to pay employees. |

| Electronic Filing | Streamlines tax filing processes, reducing paperwork and potential errors. |

| Tax Compliance | Ensures compliance with federal and state tax regulations. |

| User-Friendly Interface | Offers an intuitive platform that is easy to navigate, even for those unfamiliar with payroll. |

| Transparent Pricing | Provides clear and upfront pricing, with no hidden fees. |

| Customer Support | Offers reliable customer support to address any questions or concerns. |

For more information on these features and how they can benefit you, you can visit the official Poppins Payroll website: Poppins Payroll Official Website

The service also offers tax-related services. The employer is responsible for paying the FUTA (Federal Unemployment Tax Act) tax rate of 6% on the first $7,000 of wages paid to the nanny. However, if the employer pays state unemployment taxes, they may qualify for a credit, which lowers the FUTA rate to 0.6%. Detailed information is available in IRS Publication 926 and the Poppins Payroll guide, breaking down every aspect of payroll management.

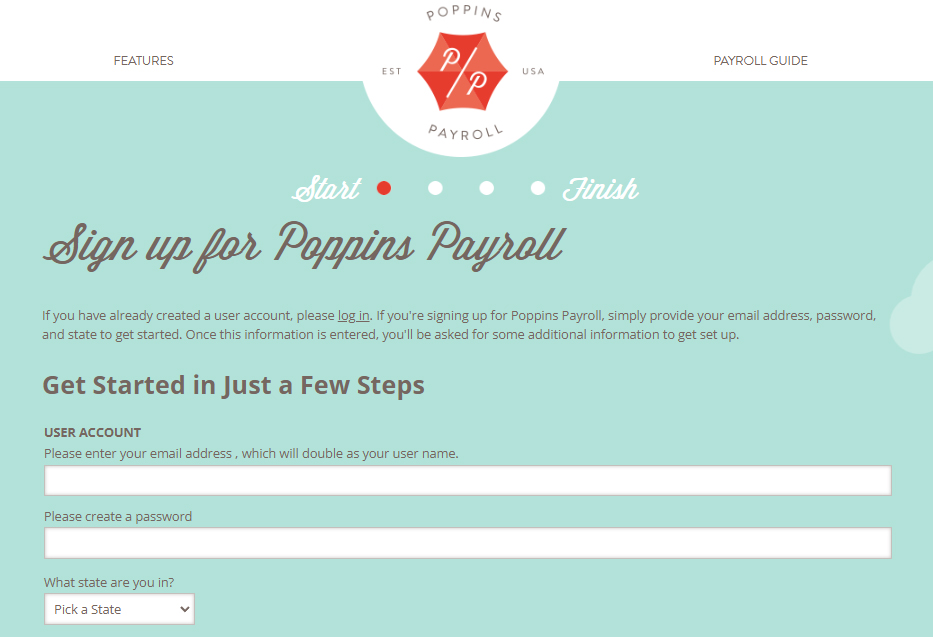

The simplicity of the sign-up process is another hallmark of Poppins Payroll. Users simply enter the employer information (thats you) and employee information (the person you're paying) once, and the system takes care of the rest. Getting started is a breeze, requiring just a few steps. The user-friendly dashboard allows you to quickly and easily revise payroll with a couple of clicks, and email reminders keep you on track at the end of each work period, allowing for any necessary adjustments. This proactive approach ensures that your payroll is always up-to-date and accurate.

Consider the state of Virginia, where the minimum wage is currently $13.50 per hour. This will increase to $15 on January 1, 2026. Household employers in Virginia must pay overtime at 1.5 times the regular rate of pay after 40 hours of work in a calendar week. Poppins Payroll is designed to handle these details, ensuring you're always in compliance with state and federal regulations. It effortlessly calculates the appropriate withholding amounts and ensures all taxes are filed correctly.

Poppins Payroll is a service specifically designed for household employees. They offer basic payroll services as well as tax filings for a flat monthly fee. They advertise themselves as sensibly priced. Superbly professional. They have excellent customer reviews on the BBB website.

Poppins Payroll stands out in the crowded landscape of payroll services through its ease of use and comprehensive service offerings. It provides an affordable way to manage payroll for nannies, senior caregivers, housekeepers, and other household staff. Priced at $49 monthly for one worker, it handles all nanny payroll and tax processesfrom depositing payments to employee accounts and remitting payroll taxes to electronically filing tax forms for you.

Users have consistently praised Poppins Payroll for its simplicity, reliability, and transparency. One user shared their experience of hiring a temporary nanny, finding the prospect of managing a household employee daunting. However, Poppins Payroll made the process straightforward and stress-free. Many users have expressed that Poppins Payroll saved them significant time and worry, handling all aspects of payroll and taxes affordably. They've found it to be incredibly easy to update nanny hours each week without having to think about taxes, with Poppins Payroll taking care of everything reliably.

The platform's user interface is another of its strengths, described as colorful, enjoyable, and transparent in its presentation of services and fees. A well-designed interface and a transparent pricing structure are essential components of a positive user experience.

While the service is already robust, Poppins Payroll is continuously evolving. The company is moving towards offering its services in all 50 states, ensuring greater accessibility for families across the country. This expansion reflects its commitment to meeting the diverse needs of its users, providing a consistent and reliable payroll solution nationwide.

Poppins Payroll is the only payroll service on our list that does not charge extra for other additional serviceseverything is included in the monthly fee. It is also very easy to use, and even users not familiar with payroll can navigate it. Whether you're a first-time employer or have experience, this service offers an accessible and dependable solution.

The service's flat monthly fee model offers significant value. It includes a full suite of services, ensuring that users are not burdened by unexpected costs. This transparent pricing structure is a key differentiator in the market and a significant draw for families looking for an affordable, all-inclusive solution.

The testimonials speak volumes about the quality and reliability of Poppins Payroll. Users repeatedly highlight the time savings, the reduction in stress, and the overall ease of use. For many, it's not just a payroll service; it's a partner that helps them manage their household employees efficiently and legally.

In conclusion, Poppins Payroll offers a compelling solution for families seeking to simplify and streamline their household payroll processes. Its user-friendly interface, transparent pricing, and comprehensive features make it an ideal choice for anyone employing a nanny, housekeeper, or other domestic staff. By taking the burden out of payroll management, Poppins Payroll allows families to focus on what matters mostenjoying their time with their loved ones and ensuring their household runs smoothly. By providing automatic calculations, direct deposit, electronic filing, and more, Poppins Payroll proves that managing household payroll doesnt have to be a daunting task. It's a partner that takes the guesswork out of complex financial obligations.