Are you leaving money on the table? Maximize your tax refund by claiming all available credits and deductions in New York!

Navigating the intricacies of New York State taxes can feel like traversing a labyrinth. From understanding tax brackets to deciphering eligibility for various credits, the process can often seem daunting. However, the potential rewards a larger refund, reduced tax liability, or simply a better understanding of your financial obligations make it a worthwhile endeavor. This article aims to demystify the New York State tax system, providing you with the essential information you need to confidently navigate the process. We will explore key aspects of New York State income tax, including rates, brackets, credits, and filing requirements, ensuring you are well-equipped to manage your tax responsibilities effectively. The goal is to empower you with the knowledge to take control of your tax information and make informed decisions that benefit your financial well-being.

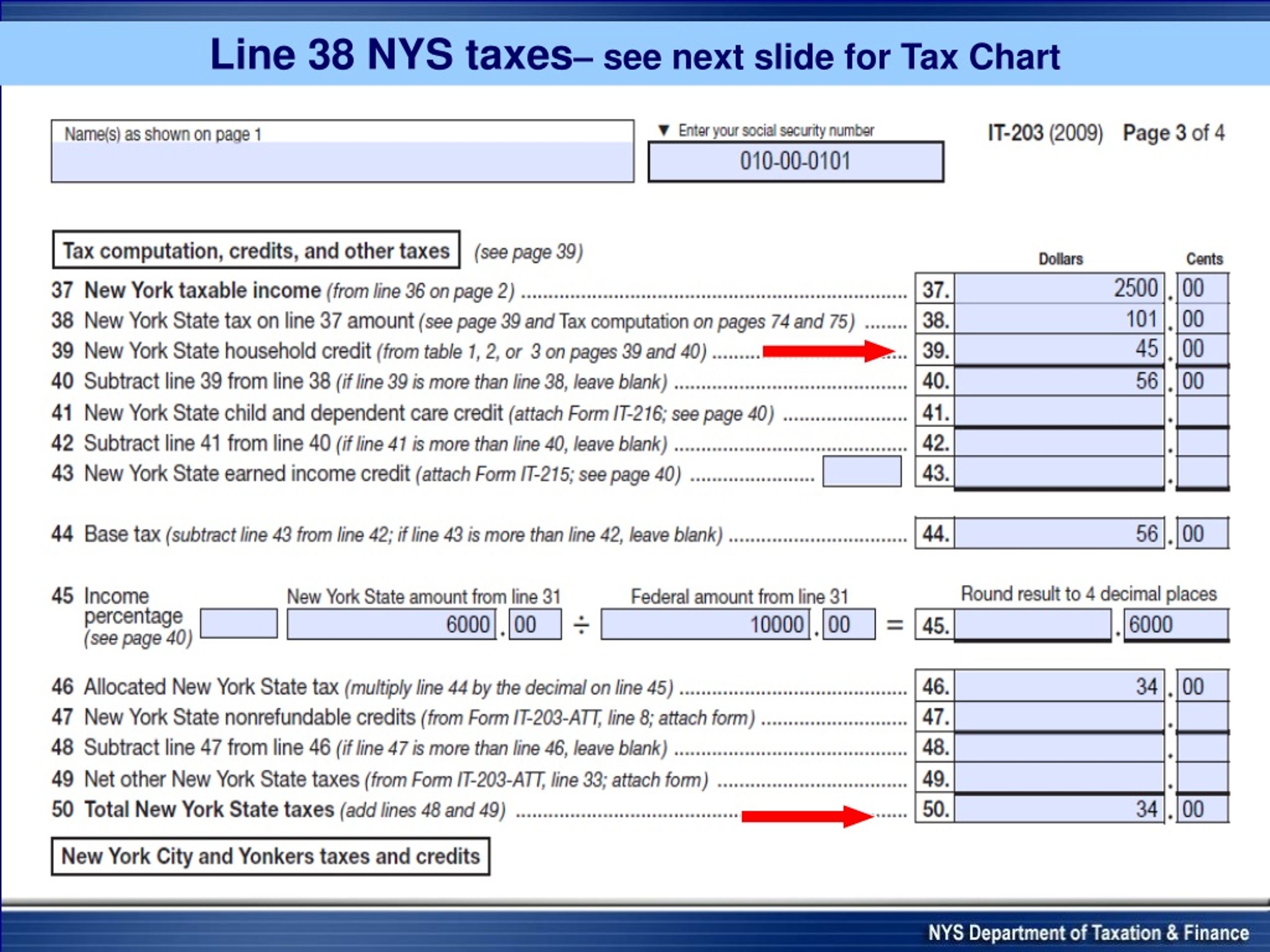

To better illustrate the impact of New York State's tax structure, let's consider a hypothetical scenario. Imagine a single filer with a modest income. By simply understanding the available credits, such as the Earned Income Credit or the Household Credit, this individual could potentially reduce their tax burden significantly, leading to a larger refund or lower tax liability. The key is to be informed and proactive, taking advantage of the resources available to you. Furthermore, knowing how to calculate your New York income tax based on residency, filing status, and income level is paramount. The availability of tools, such as the New York tax calculator, can be of great assistance in this regard, allowing you to estimate your tax liability and plan accordingly.

The information presented here is sourced from the New York Department of Taxation and Finance and is current as of [Current Date]. However, tax laws are subject to change, so it is always advisable to consult the official NY.gov website for the most up-to-date information. Remember that the Department of Taxation and Finance is an official New York State government organization, and its website is the most reliable source of information regarding tax matters.

Key Aspects of New York State Income Tax

New York's income tax system is built on a progressive structure. This means that the more you earn, the higher the percentage of your income you pay in taxes. For 2025, New York State employs nine tax brackets, with rates ranging from 4% to a maximum marginal rate of 10.900%. This is a critical piece of information for understanding your potential tax liability. These tax brackets determine the percentage of your income that will be taxed at each level, and the specific amount you owe is calculated based on your taxable income.

Furthermore, It is important to note that the New York tax system can be complex, and the specifics of tax rates and brackets are detailed on the official New York State Department of Taxation and Finance website. To stay informed, its advisable to periodically review the tax tables and schedules to ensure that you have the most current information. Changes in these tables can influence your tax burden and the amount of any refund you may receive.

Beyond income tax, New York also has sales and property taxes. Sales tax rates vary depending on the locality, while property tax rates are determined by the specific municipality. Understanding these tax obligations, in addition to income tax, is a crucial part of your financial responsibilities as a New York resident.

New York state is committed to providing a convenient and accessible platform for taxpayers. Online services allow individuals to pay bills, file tax extensions, respond to department notices, and sign up for refund notifications. By utilizing these resources, taxpayers can efficiently manage their tax obligations and have easy access to pertinent information.

Tax Credits and Benefits

One of the most significant aspects of tax planning is understanding the credits available to reduce your tax liability. New York State offers several credits that can potentially increase your refund or decrease the amount you owe. Exploring available credits can substantially impact your tax position. Here's a breakdown of some popular credits:

- Earned Income Credit (EIC): This credit is designed to help low-to-moderate income workers. The eligibility for EIC is based on earned income, adjusted gross income, and the number of qualifying children.

- New York City Earned Income Credit: Similar to the state EIC, NYC also offers an EIC for eligible residents.

- Household Credit: This credit can be claimed by certain residents, and it's often determined by the taxpayer's filing status and income.

- New York State Child Tax Credit: Provides financial relief to families with qualifying children.

To claim these credits, you must meet specific eligibility requirements and file the appropriate tax forms. The official NY.gov website provides comprehensive information on these and other credits. It's crucial to carefully review the requirements for each credit to determine if you are eligible. Additionally, the New York Department of Taxation and Finance is constantly updating its guidance, so it's a good idea to frequently check the department's website or contact them with questions.

Filing Your New York State Tax Return

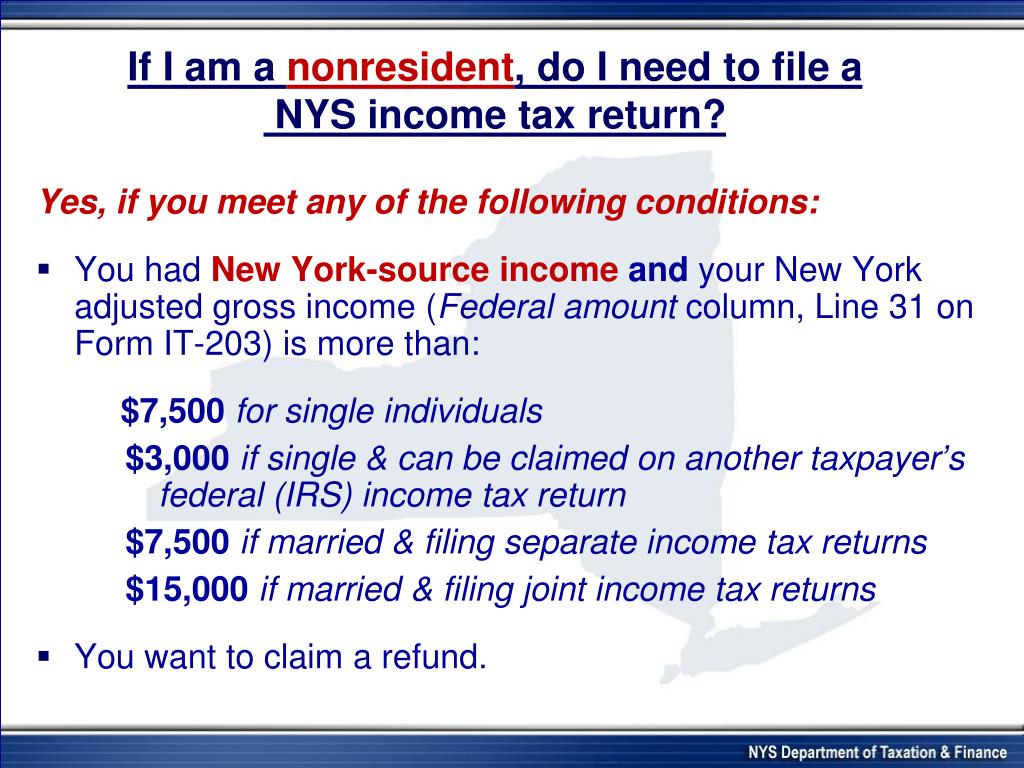

Typically, if you are a New York State resident and are required to file a federal income tax return, you must also file a New York State income tax return. However, even if you are not required to file a federal return, you may still be required to file a state return if your combined federal gross income and New York additions exceed a certain threshold (e.g., $4,000 or $3,100 for single filers).

When preparing your return, you'll need to gather all necessary documentation, including your W-2 forms, 1099 forms, and any other documents related to income, deductions, and credits. You can file your return online, by mail, or through a tax preparer. Regardless of the method you choose, accuracy is key. Double-check all information before submitting your return to avoid any delays or errors.

For those who need an extension, New York State offers the option to file an income tax extension. Keep in mind that an extension gives you more time to file, but it does not extend the deadline for paying any taxes owed. Therefore, it is recommended to estimate your tax liability and pay any taxes due by the original filing deadline to avoid penalties and interest.

Resources and Tools

The New York Department of Taxation and Finance offers several resources to assist taxpayers. The official NY.gov website is your primary source for forms, instructions, publications, and other tax-related information. You can also access online services to pay bills, check your refund status, and manage your account. With an individual account, you can manage your tax information.

One of the most useful tools is the New York income tax calculator. This calculator allows you to estimate your tax liability based on your filing status, income, and other relevant factors. The calculator is regularly updated to reflect the latest tax laws and rates. Also, there are tax tables that provide information about tax rates, thresholds, and allowances.

The website also has information that helps you to understand your refund status, respond to a request for information, and troubleshoot common issues. If you need to contact the Department of Taxation and Finance, be sure to use the contact information provided in any correspondence you receive. Responding to department bills or notices promptly, and uploading any requested documentation through the methods outlined, can help you avoid delays in processing your tax return. If a fax number is provided, use only that number for faxing information.

Important Considerations

Keep in mind that New York's tax laws can be complex and are subject to change. It is crucial to stay informed about the latest updates, credits, and tips. The tax brackets and rates are updated and available on the official New York State Department of Taxation and Finance website. Also, you can use the New York income tax calculator to estimate your tax liability.

Furthermore, remember that there is no central fax number for the New York State Department of Taxation and Finance. If you need to submit documents, always use the fax number provided in the correspondence you receive or on the relevant forms or instructions. This will help ensure your information is processed correctly and efficiently.

Finally, while the state offers various services online, always be wary of unsolicited communications requesting personal information. A genuine NY.gov website belongs to an official New York State government organization. Ensure you are on the correct website before entering any sensitive data.

The Department of Taxation and Finance is committed to providing taxpayers with a user-friendly and efficient tax system. Building on initiatives to make New York more accessible and affordable, the state offers programs designed to assist taxpayers. New Yorkers can take advantage of these resources to effectively manage their tax obligations.

If you need further assistance, you can also find detailed information about sales and use tax on the official NY.gov website, including information regarding collections of rent on and after March 1, 2025.

For the 2024 tax year, the tax tables below include the tax rates, thresholds, and allowances included in the New York tax calculator 2024. Information about tax rates and tax tables for New York State, New York City, Yonkers, and the Metropolitan Commuter Transportation Mobility Tax by year are also provided on the official website.

The ultimate goal is to enable New Yorkers to save time and money. By understanding the tax system and taking advantage of available resources, taxpayers can confidently manage their tax responsibilities.

| Category | Details |

|---|---|

| Subject | New York State Income Tax |

| Overview | Comprehensive guide to New York State income tax, including rates, brackets, credits, and filing requirements. |

| Key Elements |

|

| Tax Rates and Brackets (2025) |

|

| Credits Highlighted |

|

| Filing Requirements |

|

| Tax Calculator & Tables |

|

| Official Website | New York State Department of Taxation and Finance |